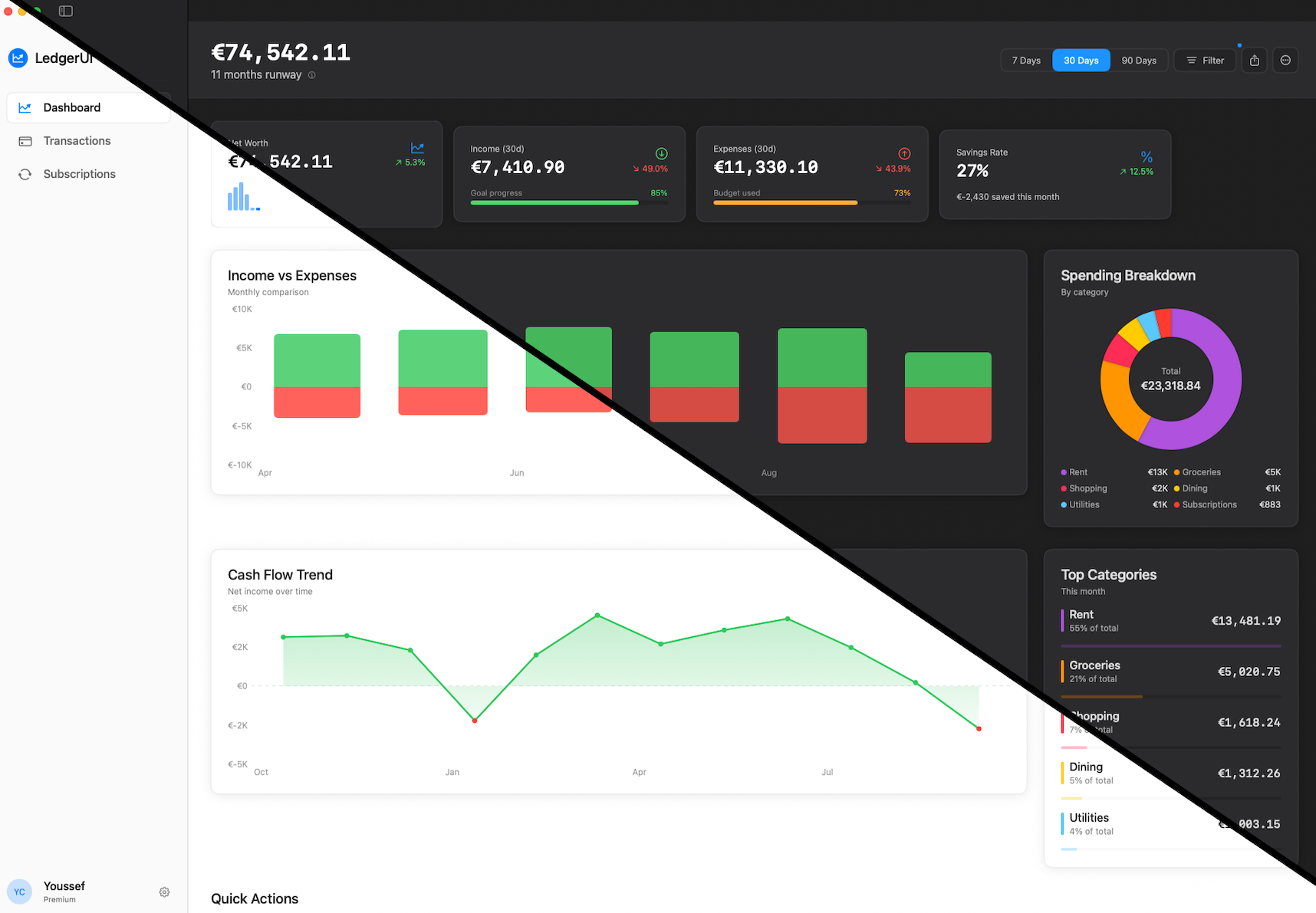

Building LedgerGlass: Why I Built a Privacy-First Finance App for macOS, How It Works, and What’s Next

If you’ve ever tried to keep a clean pulse on your personal finances without handing everything to a cloud service, you know the trade-offs: great charts usually come with account scraping, background syncing, or “trust us with your data.” I wanted the opposite, a beautiful, modern, Mac-native experience that keeps every byte on my machine.

LedgerGlass is that itch scratched: a SwiftUI app that turns bank CSVs into an insight-rich, privacy-first personal ledger. It uses SwiftData for storage and Apple’s NaturalLanguage embeddings for on-device categorization. No servers, no keys, no tracking.

TL;DR

- A native macOS app (SwiftUI + SwiftData) that imports bank CSVs and visualizes spending, cash flows, and subscriptions.

- On-device ML categorization with NaturalLanguage — works offline, respects privacy.

- New Subscriptions Calendar with color-coded amounts and month navigation.

- Thoughtful design system, light/dark themes, and modern macOS ergonomics.

- Next up: bank statement support (OFX/QFX/MT940/PDF) with reconciliation, plus budgets/alerts, forecasting, multi-currency with FX, iCloud sync (opt-in, E2E), and deeper rules/automation.

Why I built it

- Privacy by default: I wanted a ledger that never ships my transactions to a third party.

- Delightful by design: Financial software should feel calm and responsive, not transactional and clunky.

- Learn the latest Apple stack: SwiftData, SwiftUI’s modern navigation, NaturalLanguage embeddings, and Charts.

- Own my data: CSV import/export with simple backups, and no vendor lock-in.

What I set out to build (constraints I kept)

- Offline-first. Everything runs locally; network is optional and never required.

- Mac-native. Embrace SwiftUI, SwiftData, menus, keyboard shortcuts, and system conventions.

- Human-readable storage. CSV in, CSV (or more) out.

- Fast enough to be fun. Import, recategorize, and navigate without waiting spinners.

From servers to SwiftUI: the confusing (and oddly refreshing) part

Most of my work lives in the land of APIs, data pipelines, and agents — spin up a service, define clean boundaries, ship JSON, scale horizontally, measure. Building a macOS app flipped that on its head in a good way.

What felt confusing at first:

- State everywhere, all at once. Coming from stateless requests, juggling

@State,@StateObject,@Environment, and@Queryfelt like learning a new traffic system. The fix: be ruthless about where state lives and push heavier work into services. - App lifecycle & scenes. Servers boot once and run forever; apps wake, sleep, and juggle windows. Understanding

AppvsScenevsWindowGroup, and when to persist vs recompute, took a minute. - Sandboxing & file access. In backend land, you read files. On macOS, you ask politely. Security-scoped bookmarks, open panels, and user intent are the rules. It’s extra steps — and it’s the whole point of local-first trust.

- Keyboard-first ergonomics. I’m used to CLI speed; making a GUI that’s actually faster with shortcuts, focus rings, and command menus was a design problem, not just a tech problem.

- Latency mindset. A server can hide a 200 ms hop; a desktop UI can’t. Every parse, every fetch, every redraw has to feel instant.

Why it was fresh:

- Tighter feedback loop. SwiftUI previews + small view models = build–run–fix cycles that feel like a REPL for UI.

- Ownership. No glue services, no brittle web layers, just the app, the data, the user.

- Craft. Tiny hover states, elastic grids, and consistent spacing make software feel calm. You can feel the quality when it’s right.

This stretch from “API brain” to “app brain” is exactly why I wanted to do LedgerGlass native. It forced better boundaries (models/services/views), more empathy for interaction, and a deeper respect for platform patterns.

How LedgerGlass works

Architecture at a glance

- SwiftData models: Account, CategoryEntity, TransactionEntity, SubscriptionEntity.

- Services:

- CSVParsing: delimiter detection, robust quoted fields, type/amount inference.

- ImportService: orchestrates mapping, account creation, categorization, and subscription detection.

- OnDeviceCategorizer: NaturalLanguage embeddings to map transactions to user categories.

- AgentService: post-import enrichment (categorize + recurring detection).

- AnalyticsService: cash-flow, spending breakdowns, category-aware totals.

- Views: Dashboard, Transactions, Subscriptions (List + Calendar), Settings, Category Manager.

- Design: a lightweight design system for colors, typography, spacing, and modern button components.

Import pipeline

- You drop in a CSV from your bank.

- The parser detects delimiters and handles quoted fields.

- Amounts are inferred from common bank patterns (Amount, Credit/Debit, Type columns).

- Accounts/transactions are created, then enrichment runs: categorization + recurring detection.

On-device categorization (NaturalLanguage)

- I embed category names/descriptions and compute similarity to each transaction.

- You can correct categories; those improvements are reflected immediately (and influence heuristics).

- No API keys, no network calls.

Subscription detection

- Looks for cadence (weekly, monthly, yearly, etc.) plus amount consistency.

- Tracks lastDate + period to project future billing dates.

- Feeds the Subscriptions Calendar so you can “see the month” at a glance.

Subscriptions Calendar (new)

- macOS-style monthly grid with weekday headers and today highlighting.

- Uses all available space; cells scale to the window.

- Color-coded by total expected charges for the day:

- Green < 50, Yellow 50–100, Orange 100–200, Red 200+

- Currency symbol matches your Settings.

- Click a day to view all charges due on that date.

Dashboard

- Stacked category bars per month with a spending trend line.

- 90-day spending breakdown and quick stats.

- Light/dark themes with thoughtful contrast.

Transactions

- Fast search, filter pills, context actions.

- CSV import is a first-class citizen.

- Re-label all with one action if you adjust categories.

Settings

- Manage Categories (inline editing, color picker, kind selection).

- Preferred currency (reflected across the app, including the calendar).

- Re-run enrichment & Re-label All.

- Erase All Data: clears the SwiftData store (useful after schema changes).

Screenshots (from the repo’s

screenshots/folder):

dashboard-light-dark.png— Dashboardtransactions.png— Transactionssubscriptions-list.png— Subscriptions Listsubscriptions-calendar.png— Subscriptions Calendar (color-coded)

What I learned

SwiftData in a real app

- Schema changes are pleasant… until they aren’t. I added defaults and an Erase-All-Data escape hatch for stubborn migrations.

- Fetching with

@Querymakes SwiftUI views feel reactive; still, I prefer isolating heavier computations in services.

NaturalLanguage embeddings are practical

- For finance categorization, embeddings + a small rules layer go a long way.

- Descriptive category names/descriptions materially improve accuracy.

- Deterministic heuristics + similarity scores > heuristics alone.

SwiftUI Layout on macOS

- Using

GeometryReaderto size calendar cells to the available space made the calendar feel “native.” - Swapping a segmented control for custom buttons gave better consistency with the design system.

- Small hover/press states add a lot of perceived quality.

Sandboxing realities

- Security-scoped URLs mean: always pick files through the open panel.

- It’s worth it for local-first peace of mind.

Developer ergonomics

- Xcode 16’s build/test pipeline is fast enough to keep the loop tight.

- A tiny design system (colors/typography/spacing) beats inline one-offs — easier to refactor and theme.

The mindset shift

- Treat services like micro-backends inside the app: pure inputs/outputs, no view logic.

- Budget every millisecond the user can feel.

- Design hot paths first (import, search, recategorize) and make them keyboard-native.

Closing thoughts

LedgerGlass is my answer to a simple question: can personal finance software be beautiful, fast, and private by default? Building it with the latest Apple stack has been both a joy and a learning lab — and yes, jumping from APIs/web to macOS was confusing at first, in the same way switching sports feels clumsy for a week and then suddenly clicks. If you have ideas, requests, or tough CSVs (or statements), I’d love to hear from you — open an issue, share a screenshot, or suggest a rule set.

Most of all, I hope LedgerGlass helps you see your money more clearly, without giving it away.